Plug-and-play strategy,

Advisory across the

investment lifecycle

Analog Consulting is a boutique firm that sits between founders, searchers,

and investors. We help you evaluate deals, raise capital, and build the

operating systems that actually deliver the plan.

4K+

users worldwide

Who we are

Analog Consulting is a boutique firm that sits between founders, searchers, and investors. We help you evaluate deals, raise capital, and build the operating systems that actually deliver the plan.

- ✨ Providing rigorous analysis to help founders, searchers, and investors thoroughly vet potential acquisitions and opportunities.

- ✨ Strategizing and executing fundraising initiatives to secure necessary growth and investment capital.

- ✨ Designing and implementing robust processes and frameworks that translate strategic plans into tangible operational results.

Where we operate

Venture Capital

⚙️ Founders → investor-ready models, materials, and integrated operating systems after raising

🔍 VC funds → screening, diligence, models, and portfolio support when execution matters

Search Funds

🗺️ Searchers → search strategy, deal evaluation, capital structure, investor materials

📝 Search funds → deeper diligence, memos, and post-close operating systems

Private Equity

📈 Companies → getting “PE ready” with story, numbers, and systems

🔨 PE funds → underwriting support, models, memos, and value-creation execution

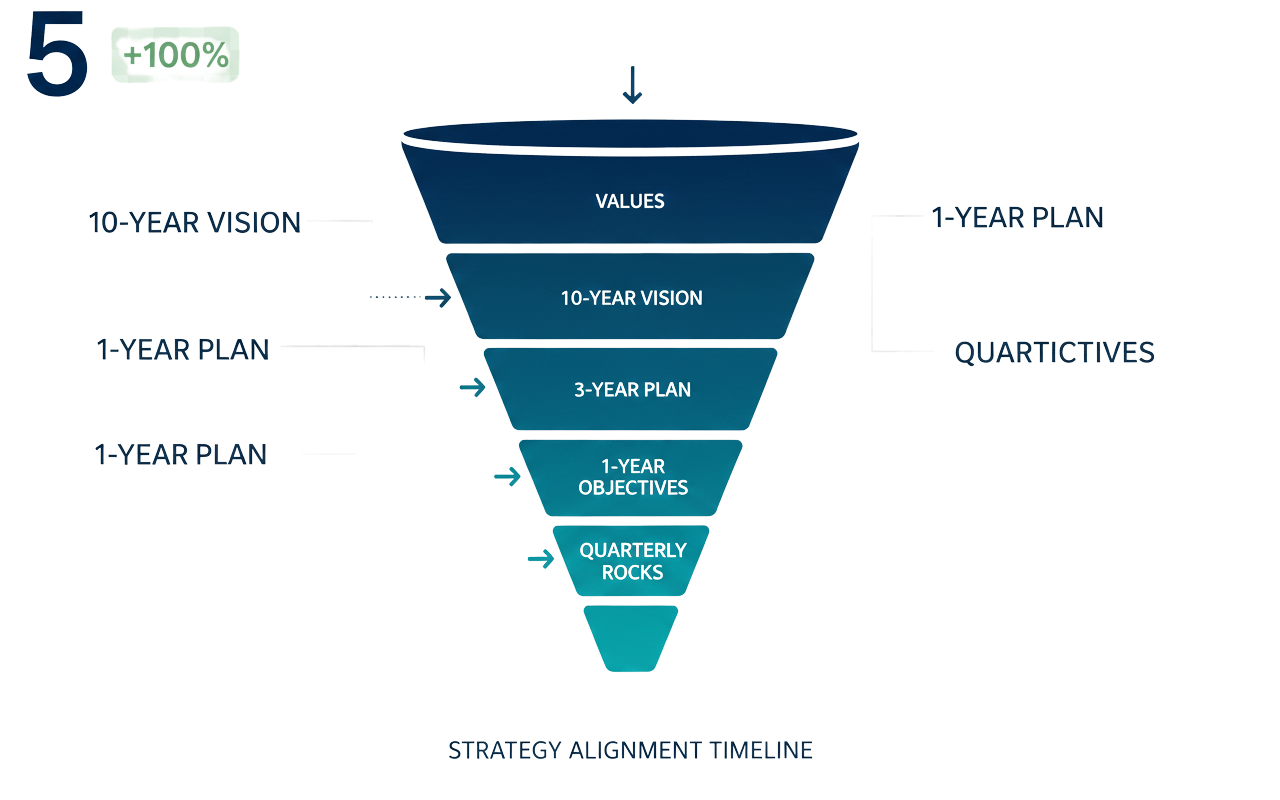

Integrated Management System (IMS)

Our specialty is installing a single Integrated Management System (IMS) where strategy across all verticals is aligned and automation sits at the core.

Selected Work & Transactions

Financial modeling, IM & investor materials, franchise DD, and full support from initial diligence through close.

IHTC

Home Health & Hospice

United States

PE acquisition of 68 hospitals and 170 SNFs; four-wall unit economics, portfolio heat mapping, value-creation planning.

Access Medical Centers (AMC)

Hospital Chain & SNF Network

United States

Financial modeling, investor materials, QoE & legal diligence support, investor conversations.

Physician Private Nursing Services Inc. (PPNS)

Home Health | United StatesValuation, LBO modeling, capital structure advisory, and investor materials for LMM buyout.

Ohio Industrial Sales (OIS)

Industrial Distribution

United States

Private placement of J$250M; valuation, deal structuring, IM, investor outreach, and turnaround/value-creation plan.

Tijule Company Ltd

Food & Beverage Manufacturing

Jamaica

$5M capital raise; valuation, model, investor materials, and outreach strategy.

Capital Raises & Growth

Ranlytics

Telecom Tech & RF Data

Pakistan Government

£250k raise; financials, investor materials, and GTM sequencing.

Atenai London

Consumer Wellness

United Kingdom

Values

Precision Over Posturing

Precision Over Posturing

Extreme Ownership

Extreme Ownership

Efficiency Is Key

Efficiency Is Key

Continuous Upgrade

Continuous Upgrade

Collaboration Without Bureaucracy

Collaboration Without Bureaucracy

Trust Is the Only Currency

Trust Is the Only Currency

Collaboration Without Bureaucracy

Collaboration Without Bureaucracy

If you’re evaluating a deal, raising capital, or fixing a portfolio company:

© 2025 Analog Consulting. All rights reserved. Developed by Digimindsol.